Some Known Factual Statements About Empower Rental Group

Table of ContentsHow Empower Rental Group can Save You Time, Stress, and Money.The 9-Second Trick For Empower Rental GroupNot known Details About Empower Rental Group The Only Guide to Empower Rental GroupEmpower Rental Group - The FactsRumored Buzz on Empower Rental Group

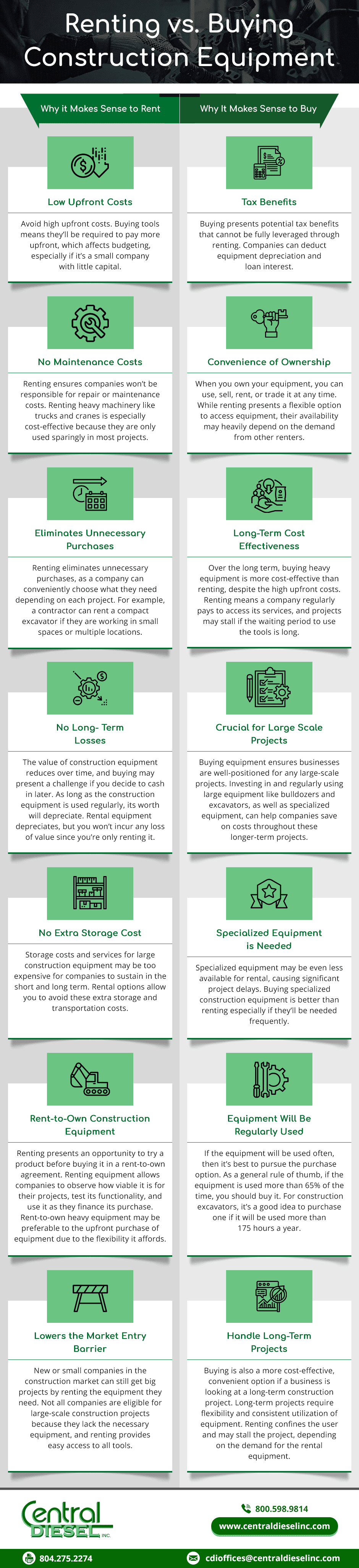

Take into consideration the primary variables that will certainly aid you decide to buy or lease your construction equipment. equipment rental company. Your existing economic state The sources and abilities offered within your company for inventory control and fleet monitoring The expenses related to purchasing and how they compare to leasing Your requirement to have tools that's offered at a moment's notification If the had or rented equipment will be used for the ideal size of time The most significant deciding element behind renting out or getting is exactly how commonly and in what manner the hefty devices is usedWith the numerous uses for the multitude of building and construction devices products there will likely be a couple of machines where it's not as clear whether renting out is the finest option monetarily or getting will offer you much better returns over time. By doing a few straightforward estimations, you can have a respectable concept of whether it's best to lease building devices or if you'll get the most take advantage of purchasing your devices.

Things about Empower Rental Group

There are a variety of various other factors to think about that will certainly come right into play, yet if your business uses a specific tool most days and for the lasting, after that it's most likely very easy to figure out that an acquisition is your ideal means to go. While the nature of future jobs may change you can compute an ideal hunch on your usage rate from recent usage and predicted jobs.

We'll discuss a telehandler for this example: Look at using the telehandler for the previous 3 months and obtain the variety of complete days the telehandler has actually been used (if it simply finished up obtaining used part of a day, after that add the parts approximately make the matching of a full day) for our instance we'll say it was used 45 days.

Empower Rental Group Fundamentals Explained

The application rate is 68% (45 divided by 66 amounts to 0.6818 increased by 100 to get a percentage of 68). There's absolutely nothing wrong with forecasting use in the future to have a best rate your future use rate, specifically if you have some proposal prospects that you have an excellent possibility of getting or have actually forecasted jobs.

If your application rate is 60% or over, acquiring is generally the very best selection. If your use price is in between 40% and 60%, after that you'll intend to take into consideration just how the other aspects associate with your organization and take a look at all the benefits and drawbacks of having and renting out (https://www.threadless.com/@rentergempower/activity). If your usage price is listed below 40%, renting out is normally the most effective choice

You'll constantly have the devices at your disposal which will be excellent for present tasks and likewise permit you to confidently bid on tasks without the problem of protecting the devices needed for the job. You will certainly have the ability to benefit from the considerable tax reductions from the preliminary purchase and the annual expenses associated to insurance coverage, devaluation, loan passion settlements, repair services and maintenance expenses and all the additional tax obligation paid on all these associated costs.

Empower Rental Group - Questions

You can depend on a resale value for your devices, especially if your business suches as to cycle in new equipment with upgraded modern technology (https://medium.com/@renterg29307/about). When thinking about the resale value, take into account the brand names and versions that hold their worth far better than others, such as the reputable line of Feline tools, so you can understand the highest resale value feasible

The apparent is having the appropriate capital to purchase and this is possibly the leading concern of every local business owner - rental company near me. Even if there is capital or credit scores offered to make a major acquisition, no one wishes to be purchasing equipment that is underutilized. Unpredictability tends to be the norm in the building and construction industry and it's difficult to truly make an educated decision concerning possible projects 2 to five years in the future, which is what you need to consider when making an acquisition that must still be benefiting your bottom line 5 years later on

Rumored Buzz on Empower Rental Group

While there are a variety of tax obligation reductions from the acquisition of brand-new tools, rental costs are likewise an accountancy deduction which can usually be handed down directly to the consumer or as a basic overhead. They provide a clear number to help approximate the specific expense of devices use for a work.

Some Known Questions About Empower Rental Group.

You can outsource tools management, which is a practical choice for lots of business that have actually discovered buying to be the finest option however dislike the extra job of equipment monitoring. As you're taking into consideration these benefits and drawbacks of acquiring building equipment, discover exactly how they fit with the way you work currently and exactly how you see your company five or perhaps 10 years in the future.